Quickbooks paycheck calculator

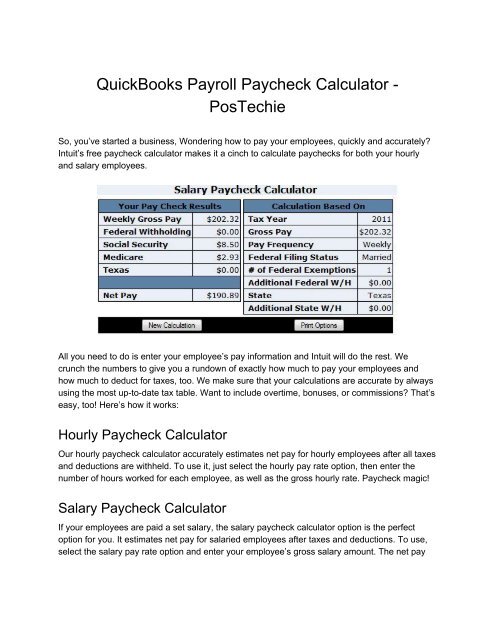

The QuickBooks Paycheck Calculator calculates net pay for salaried and hourly employees factoring in bonuses commissions and overtime worked. Based on up to eight different hourly.

Manual Payroll In Quickbooks Desktop Us For Job Costing Youtube

Menu burger Close thin Facebook.

. Gusto can streamline and handle employment tax reporting payments workers comp insurance new hire reports and detailed budget plans. 3 Months Free Trial. Once employees are set free paycheck.

Ad QuickBooks Automatically Calculates Federal State Payroll Taxes. Were sorry we cant find the page you requested. Essentially back pay is the term for wages that are.

Step 1 - Determine your filing status Step 2. Ad Learn How To Make Payroll Checks With ADP Payroll. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

Get 3 Months Free Payroll. Once you have these numbers. After taking into account your profession your market and your personal skills and experience dont forget to look at your costs of doing business.

Starting as Low as 6Month. Use QuickBooks free paycheck calculator to pay every one of your representatives whether you. Get 3 Months Free Payroll.

You may have incorrectly typed the address URL or clicked on an outdated link. Get 3 Months FreePayroll. OBTP B13696 2018 HRB Tax Group Inc.

Get 3 Months Free Payroll. Fast Easy Affordable Small Business Payroll By ADP. This free paycheck calculator makes it easy and hassle-free for you to calculate pay for all your workers including hourly wage earners and salaried employees.

One of those tabs free paycheck calculator intuit is the Accounts menu where you can find and alter checks bank accounts and expense claims and create records for your payroll needs. How do I figure out how much my paycheck will be. Make YourPayrollEffortless and Focus on What really Matters.

Ad Transform And Streamline Your Operations With NetSuite. Small Business Low-Priced Payroll Service. Get 3 Months FreePayroll.

Ad Fast Easy AffordablePayroll ServicesFor Small Business. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Ad Learn How To Make Payroll Checks With ADP Payroll.

Ad QuickBooks Automatically Calculates Federal State Payroll Taxes. Fast Easy Affordable Small Business Payroll By ADP. Back pay can be defined as the difference between the amount of pay a worker is owed versus what they actually received.

Feeling good about your numbers. In case you want to get more detailed information on QuickBooks Payroll calculators you can contact QuickBooks Payroll calculator Support. Enter your info to see your take home pay.

It also allows you to easily set up and manage 401. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. How to Calculate Payroll for Employee We live in times of flexibility and constant change hence the question of how to.

UsingPOS Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs. Heres a step-by-step guide to. QuickBooks Payroll is just open through QuickBooks Online memberships.

Heres a step-by-step guide to walk you through. Ad Transform And Streamline Your Operations With NetSuite. Total annual income - Adjustments Adjusted gross income Step 3.

Make YourPayrollEffortless and Focus on What really Matters. Get 3 Months Free Payroll. January 28 2019 DidYouKnow.

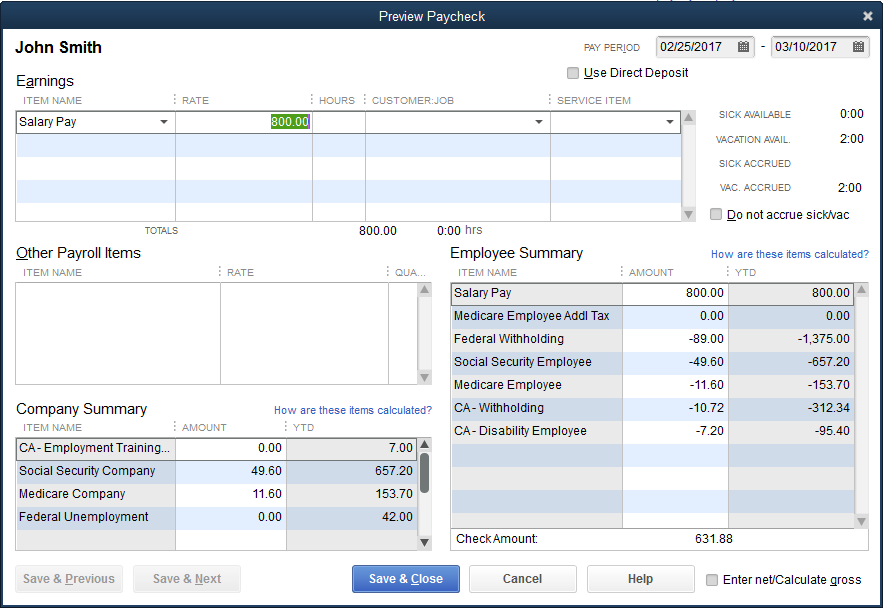

Take these steps to fill out your new W-4. Ad Fast Easy AffordablePayroll ServicesFor Small Business. Intuit has tailored specialized tool known as paycheck calculator that can be used to calculate paychecks for hourly or salary employees.

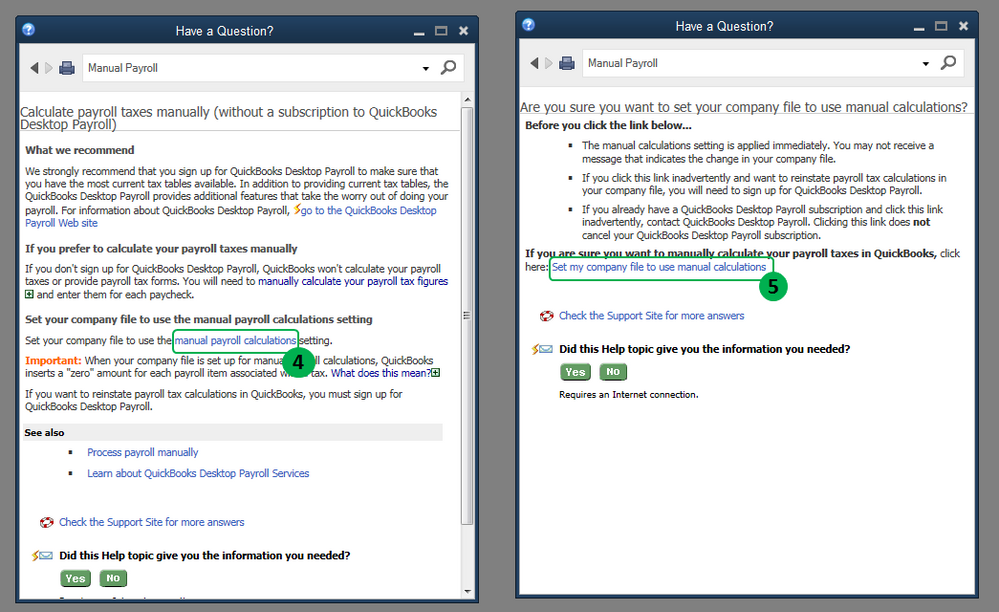

Calculating Manual Payroll Option Is Not Available

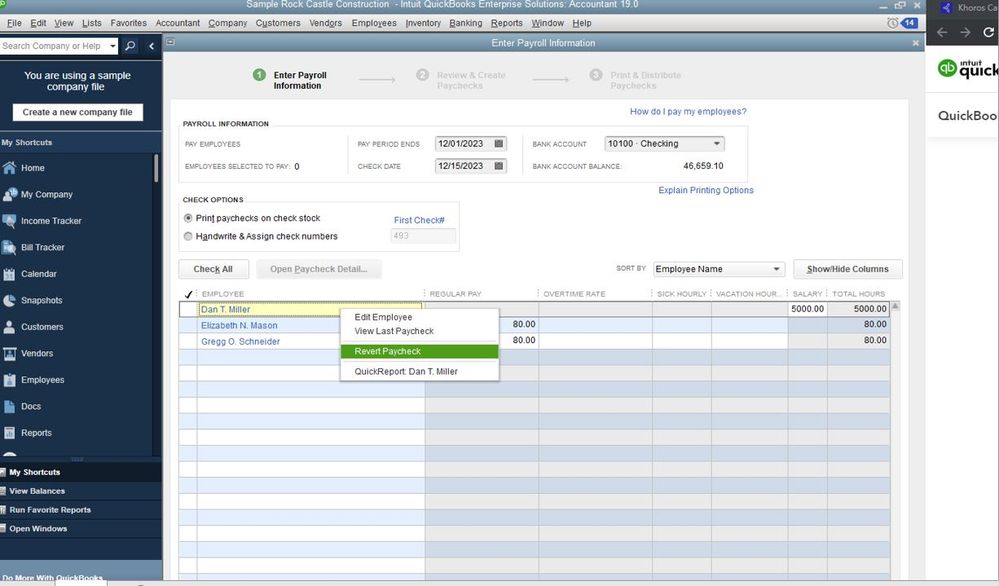

Solved How To Fix Payroll Error In Quickbooks Desktop

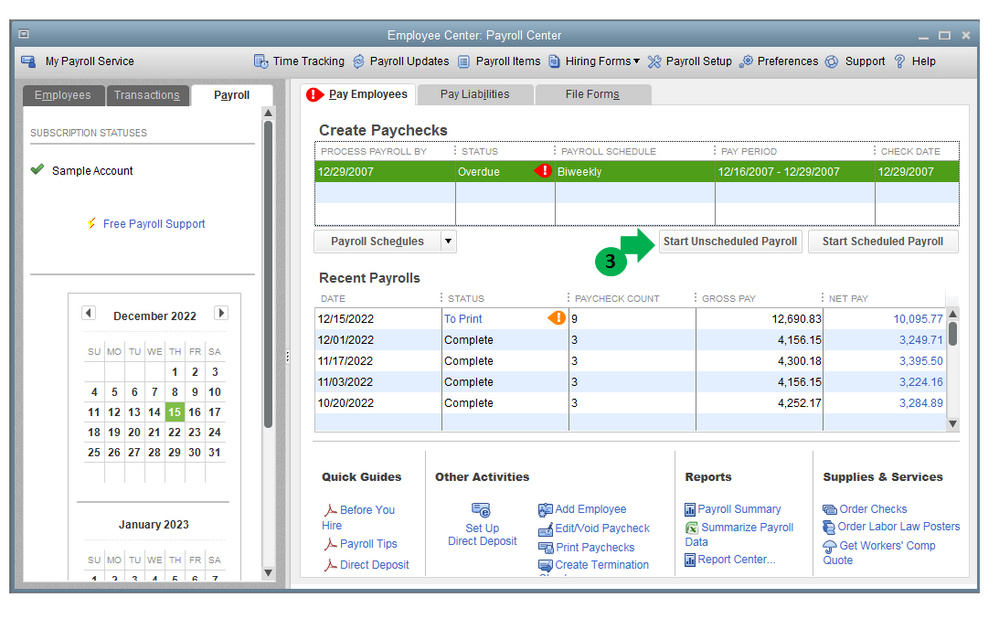

Scheduled Payroll In Quickbooks Assisted Payroll Youtube

Why Is Quickbooks Not Calculating Salary Pay Based On Peap Year For 2020

Solved Payroll Taxes Not Deducted Suddenly

Solved Payroll Taxes Not Deducted Suddenly

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Solved Other Payroll Items Not Calculating User Defined Payroll Item

Solved Federal Taxes Not Deducted Correctly

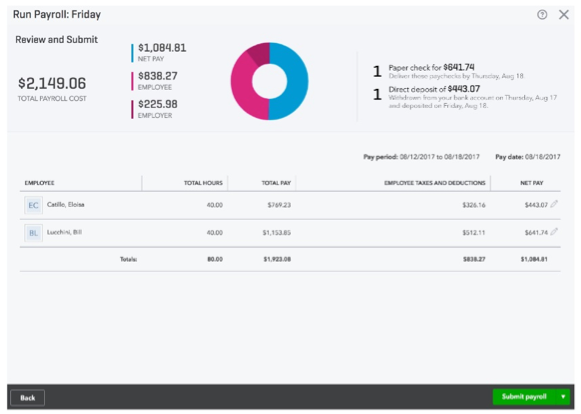

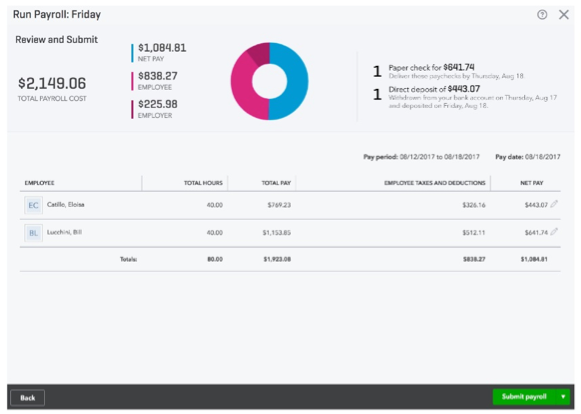

One Day Processing Now Available For Quickbooks Payroll Quickbooks

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Solved Payroll Taxes Not Deducted Suddenly

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Manually Enter Payroll Paychecks In Quickbooks Online

Fix Quickbooks Payroll Taxes Are Calculating Incorrectly Solved

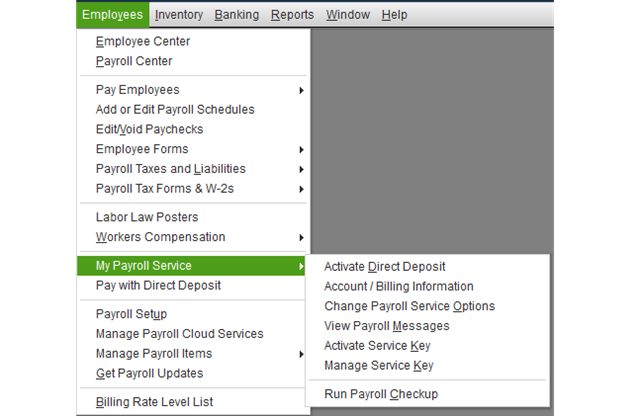

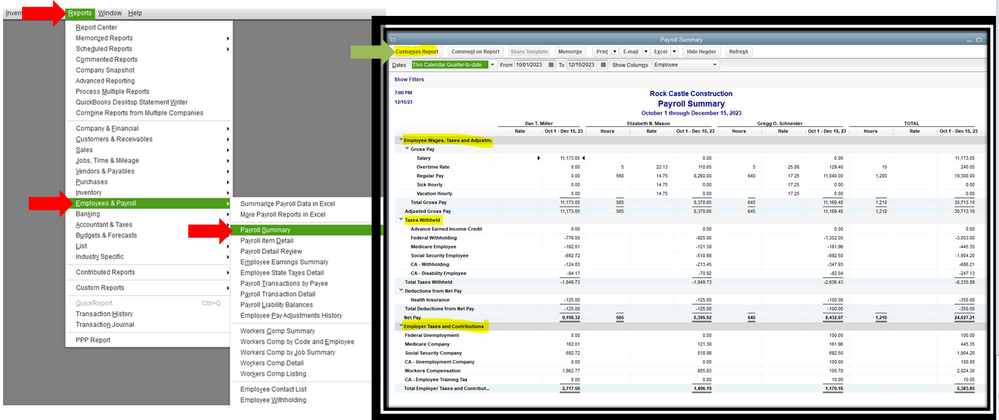

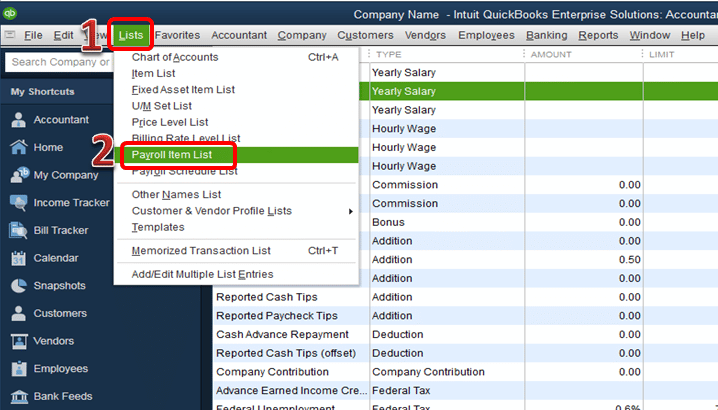

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks